We are the Leader in Construction Industry

About Ignicore Finance Private Limited

Ignicore Finance Private Limited is a new-age microfinance company, committed to empowering individuals and small enterprises with fast, accessible, and technology-driven financial services. Founded with a vision to democratize access to credit, we believe that financial freedom is a right, not a privilege.

From rural entrepreneurs to urban self-employed individuals, Ignicore stands as a trusted partner in their growth journey.

Daily Loan

Weekly Loan

Monthly Loan

Recurring Deposit

Instant Mobile Loan

Instant Bike Loan

Ignicore Finance Private Limited is a trusted microfinance company offering easy and flexible loan solutions – including daily, weekly, and monthly repayment options. Whether you need funds for personal needs, business growth, or emergencies, we are here to support you with hassle-free and transparent financial services.

Corporate Overview

Ignicore Finance Private Limited is a new-age, private microfinance institution committed to enabling financial inclusion and economic upliftment of underserved individuals and communities across rural and semi-urban India. With a deep understanding of ground-level financial challenges, we are building a system that offers easy, transparent, and technology-enabled financial solutions tailored for the working class, micro-entrepreneurs, and self-employed individuals.

Incorporated under the Companies Act, 2013, and governed by responsible business ethics, Ignicore Finance blends local trust with modern processes to simplify credit access for the masses. We specialize in daily, weekly, and monthly repayment loans, supporting self-reliance and income generation without requiring any deposit schemes or hidden commitments.

Our Vision

To be a leading microfinance institution that transforms lives by providing inclusive, responsible, and innovative financial solutions to the grassroots of India.

Our long-term vision is to empower one million+ financially excluded individuals by the year 2030, helping them achieve sustainable growth through financial literacy, micro-credit, and community-based lending models.

Our Mission

1. To offer quick, accessible, and flexible loan products that cater to everyday financial needs. 2. To drive economic empowerment through income-generating loans and structured repayment models. 3. To utilize digital platforms for simplifying onboarding, verification, and EMI collections. 4. To build a trusted ecosystem that ensures borrower dignity, transparency, and financial discipline. 5. To create employment opportunities via a decentralized field agent and branch model across districts.

Our Core Values

Ignicore Finance Private Limited is a new-age microfinance company, committed to empowering individuals and small enterprises with fast, accessible, and technology-driven financial services. Founded with a vision to democratize access to credit, we believe that financial freedom is a right, not a privilege.

From rural entrepreneurs to urban self-employed individuals, Ignicore stands as a trusted partner in their growth journey.

Our Key Services

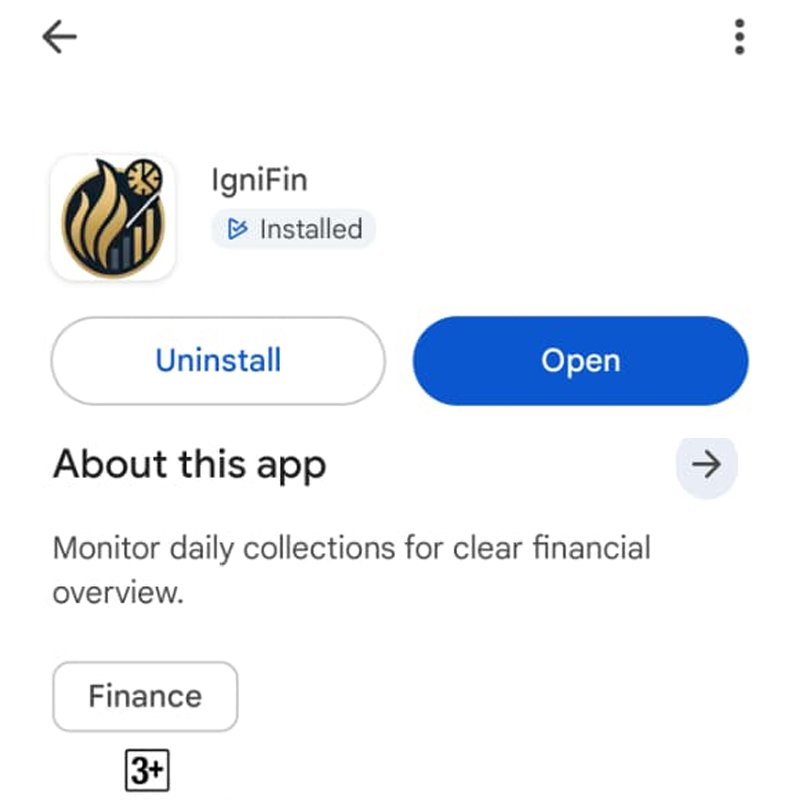

1. Daily Loan (Micro EMI Loans) 2. Weekly Group Loans 3. Monthly EMI Loans 4. Mobile Device Loans 5. Recurring Deposit (RD) Accounts 6. Loan Management Platform

Upcoming Services

Account-to-account transfers Field agent mobile app Expense tracking Profit & loss and balance sheet management SMS/WhatsApp loan alerts Biometric-based onboarding (Coming Soon)

Compliance & Legal Details

Company Name: Ignicore Finance Private Limited CIN: U66190WB2025PTC278130 PAN: AAICI1307F TAN: CALI07909G UDYAM: UDYAM-WB-16-0080550 Email: grievance@ignicorefinance.com, cc- (ignicorefinance@gmail.com) Phone: 9474714427 Registered Office: C/O: Ebadul SK, Palasbari, Bhagawangola - I, Murshidabad - 742135, West Bengal Branch Office: Balarampur, Kolan Radhakantapur, Murshidabad – 742123 Website: www.ignicorefinance.com

Why Choose Ignicore Finance Private Limited

At Ignicore Finance, we believe that financial services should be accessible, transparent, and empowering. Here’s why thousands of individuals and families are choosing us as their trusted financial partner: 1. Simplified & Hassle-Free Loan Process We understand that lengthy paperwork and delays can be discouraging. That’s why we’ve built a streamlined loan application and approval system — often completed within the same day. Our field officers and digital tools ensure quick documentation, verification, and disbursement. 2. Flexible Repayment Options (Daily, Weekly, Monthly) Whether you're a daily wage earner, small business owner, or homemaker, our custom repayment plans are tailored to suit your cash flow. Repay little by little — daily, weekly, or monthly — without stress or burden. 3. Transparent, No Hidden Charges We maintain complete transparency in all financial dealings. Every fee (application, processing, interest) is clearly communicated upfront — no surprises, no extra deductions. 4. Doorstep Service & Rural Focus Our team reaches deep into rural and semi-urban communities to bring financial services to your doorstep. We work through local agents and branch networks so you don’t have to travel or depend on middlemen. 5. Loan Options for Every Need From daily livelihood loans to mobile-based EMI schemes and group loans for women entrepreneurs — we offer multiple loan products designed to meet real-world needs, not just paperwork requirements. 6. Secure & Technology-Enabled Platform Ignicore’s tech-driven approach ensures: * Digital records of your loans * Instant payment receipts via SMS/WhatsApp * Remote device-lock for mobile loans * Biometric & OTP-based verification (coming soon) 7. Customer-Centric Philosophy Our work is guided by one principle: “Serve the customer with dignity.” We train our staff in respectful engagement, clear communication, and ethical collection practices — building lasting relationships, not just financial transactions. 8. Local Knowledge, Professional Execution As a company born in rural Bengal, we combine deep local insight with corporate-level professionalism. We speak your language, understand your needs, and offer services accordingly. 9. Recurring Deposit & Saving Tools We not only lend, we help our customers build saving habits. Our RD products allow you to grow small savings with fixed maturity value — helping you plan for the future. 10. Trusted, Compliant & Growing Ignicore Finance is: * Legally registered under MCA * Following all PAN/TAN/GST compliance * Committed to NBFC transformation * Supported by real field experience & technology investment

| Feature | Benefit |

|---|---|

| Fast Approval | Get loans within 24 hours |

| Flexible Repayment | Daily/Weekly/Monthly options |

| No Hidden Charges | 100% transparent tram |

| Rural Network | Local branches and agents |

| Tech Integration | SMS/WhatsApp alerts remote security |

| Diverse Loans | personal, group, mobile RD |

| Ethical Collection | No hasassment, full trained staff |

Future Outlook

At Ignicore Finance Private Limited, our future is guided by a vision of sustainable expansion, technological innovation, and inclusive financial empowerment. While we currently serve grassroots communities with simplified loan offerings, our strategic roadmap is centered around scaling our operations, diversifying financial products, and adopting a digital-first model to bring formal financial services to the last mile.

1. Transition Toward Licensed NBFC In the coming years, we aim to transition into a fully licensed Non-Banking Financial Company (NBFC) once we reach the required regulatory capital threshold. This move will enable us to broaden our lending portfolio, access institutional funding, and serve a wider demographic across districts and states. 2. Full-Scale Digital Transformation We are actively investing in the development of a comprehensive Fintech platform that integrates: * Paperless digital onboarding * eKYC, Aadhaar/OTP-based verification * Mobile EMI tracking and loan statements * Biometric authentication and digital signature * AI-powered credit scoring for faster approvals This digital infrastructure will not only improve customer experience but also reduce operational costs and fraud risks. 3. Rural Penetration & Branch Network Expansion Ignicore plans to expand its branch and field agent network across untapped rural and semi-urban markets in Eastern and Northeastern India. The aim is to serve over 100,000 active borrowers within the next 5 years, supported by community-based lending, SHG financing, and doorstep service models. 4. Product Diversification Beyond traditional loan offerings, our upcoming products and services include: * Recurring Deposit (RD) Enhancements with auto-debit options * Business Loans for MSMEs with minimal paperwork * Savings-Linked Loans for responsible borrowers * Digital Wallet Integration for collections and disbursements * Insurance Tie-ups for borrower protection (life & loan insurance) 5. Responsible Lending & Credit Discipline We aim to promote a culture of credit awareness, repayment discipline, and ethical collection practices. Our future roadmap includes building: * A central customer credit history system * Financial literacy campaigns at village level * AI-driven alerts and reminder systems * Credit recovery dashboards for branch managers 6. Strategic Partnerships & Investment To fuel this growth, Ignicore is open to: * Equity investment from impact investors, VCs, and social finance platforms * Partnerships with local NGOs and SHGs for outreach/br> * Bank/NBFC collaborations for co-lending and capital support

Our 5-Year Vision

| Goal | Target |

|---|---|

| Licensed NBFC Registration | Within 3 years |

| Active Borrower Base | 1,00,000+ |

| Branches/Field Units | 200+ |

| Tech-Enabled Operations | 90% paperless |

| New Financial Products | 5+ offerings |

| Rural Financial Literacy Events | 1,000+ |